Stewardship. Strategy. Legacy.

We help founders and executives make clear, deliberate financial decisions with long-term purpose. Guided by our 3E philosophy—Educate, Elevate, and Empower—we equip clients with understanding, perspective, and confidence so their financial lives support, rather than distract from, their greater purpose.

Work with us

Work with us

Work with us

Services

Services

Services

What Makes Us Different

Most advisors manage accounts. We manage decision fatigue..

Comprehensive Financial Planning & Strategy

This is the foundation of every client relationship. We build a coordinated financial strategy that integrates cash flow, investments, taxes, risk management, and long-term goals into a single plan. The objective is clarity, prioritization, and confident decision-making—not disconnected recommendations.

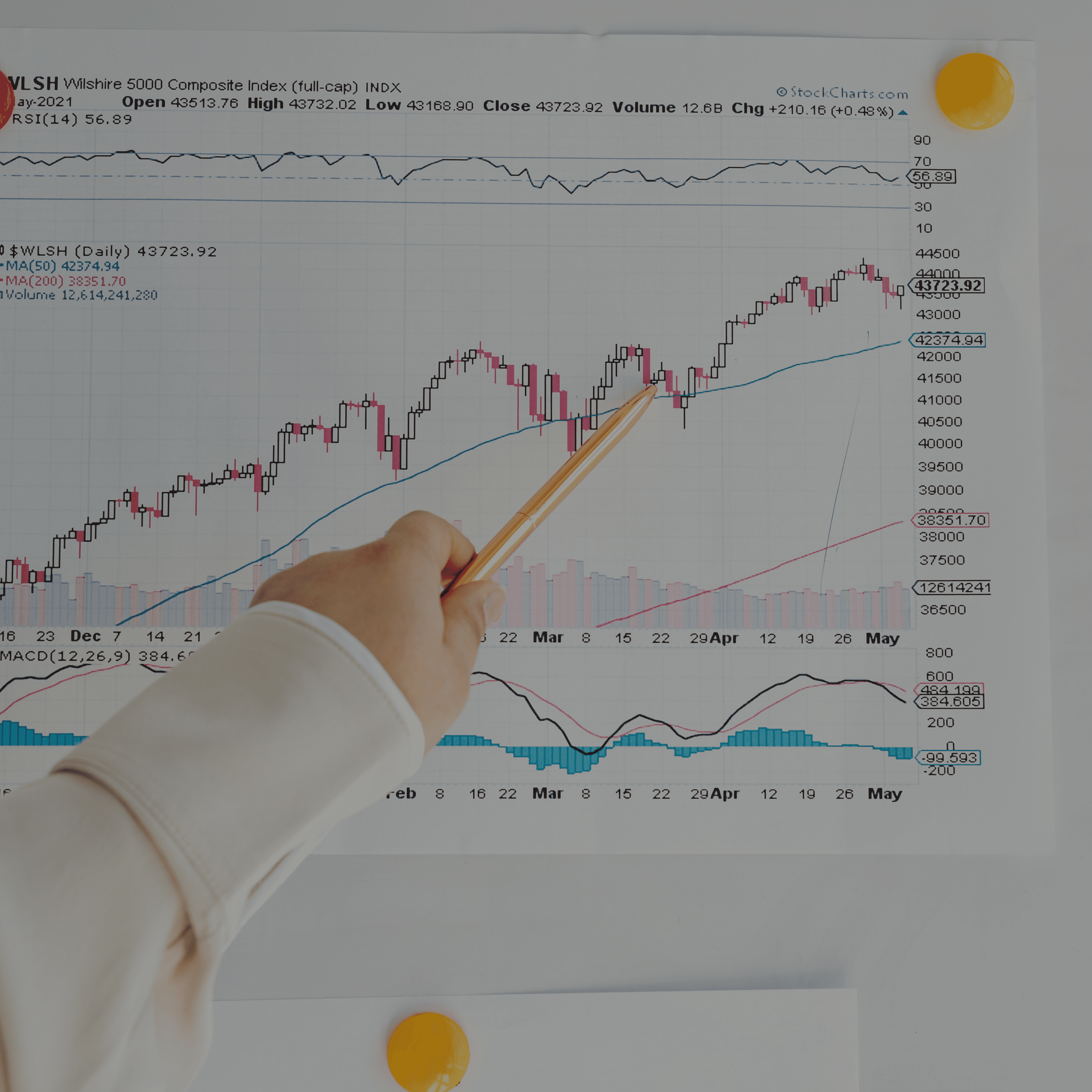

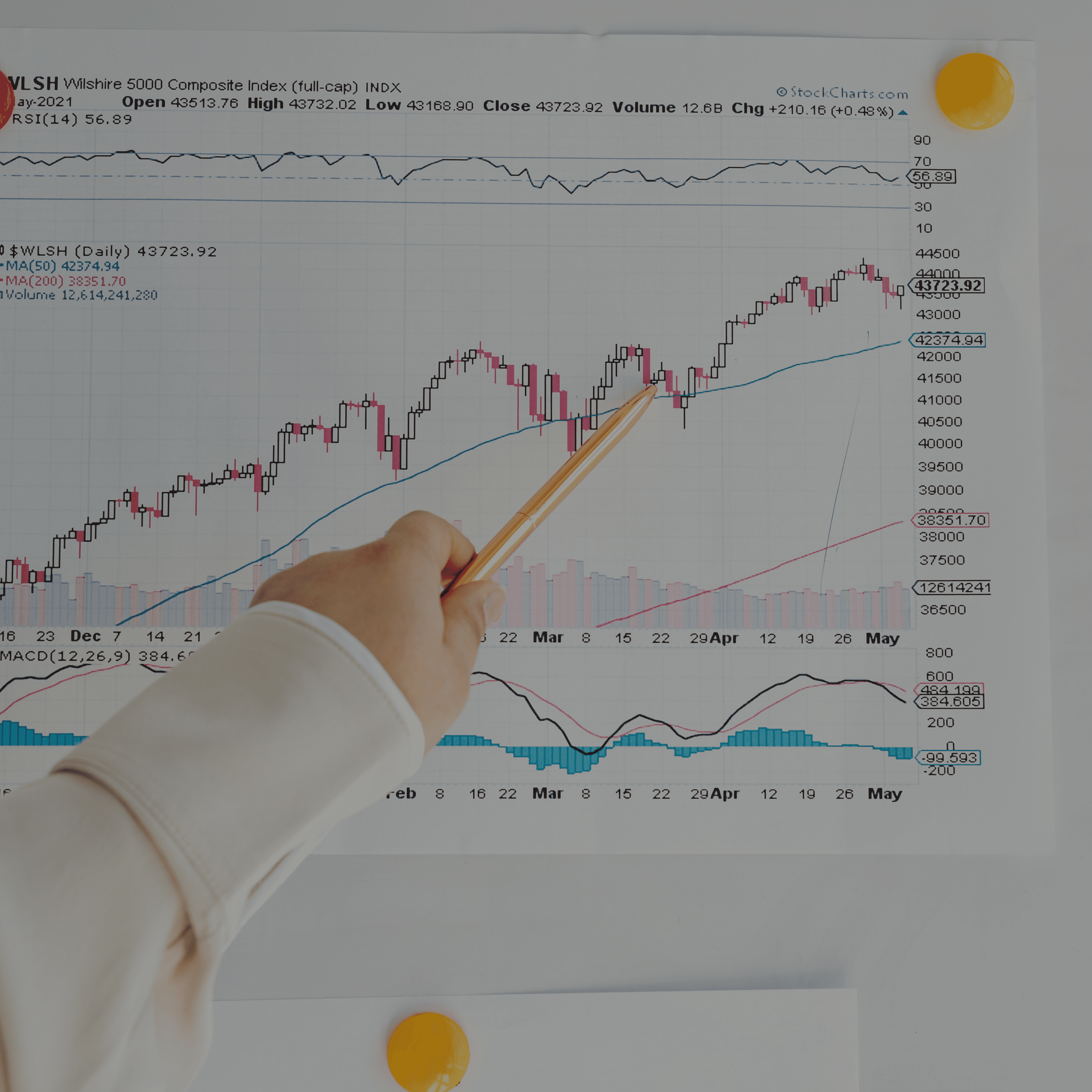

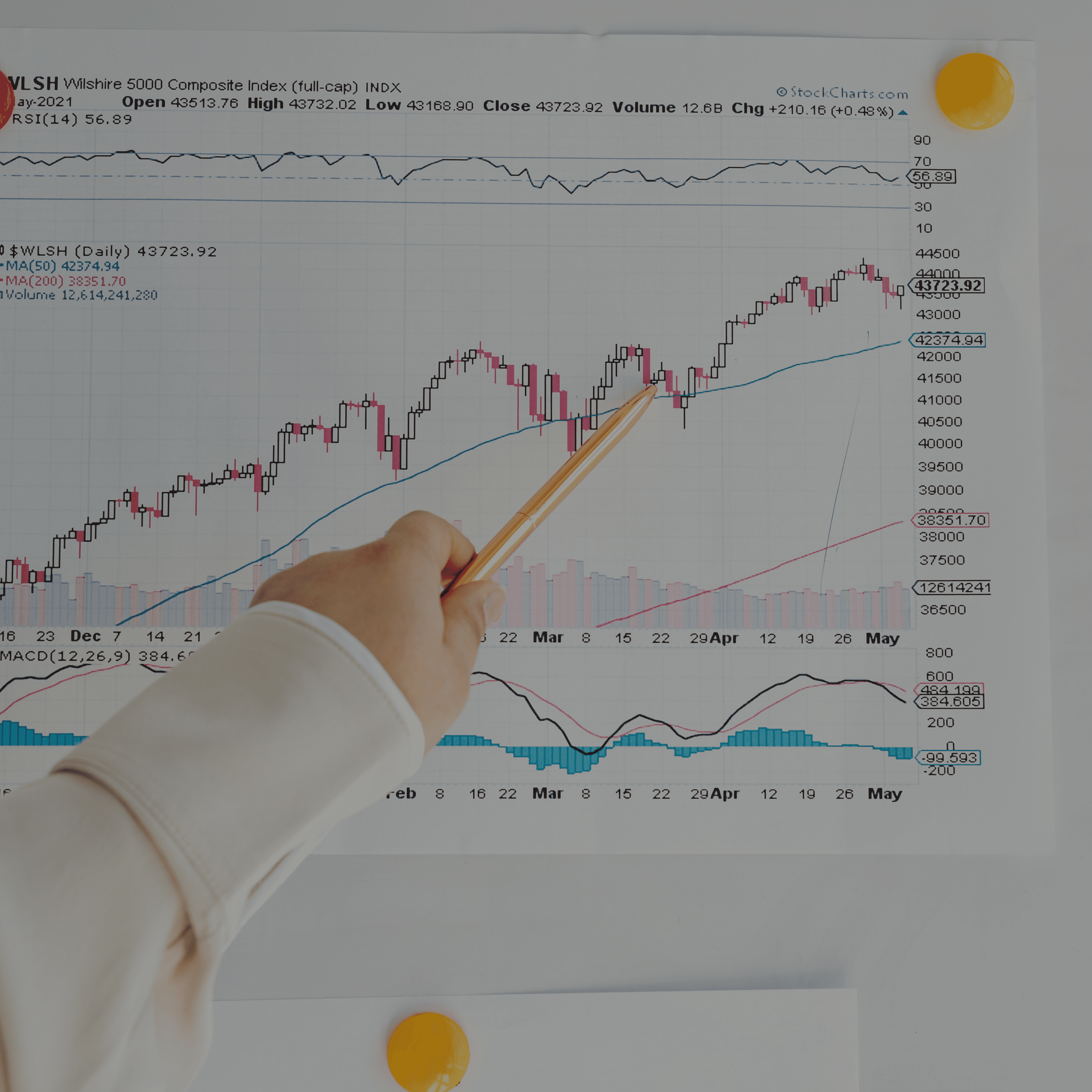

Investment Oversight & Asset Management

When clients engage us for asset management, we provide disciplined portfolio construction, monitoring, and ongoing oversight aligned to their broader strategy. Investment decisions are made in context—considering taxes, liquidity needs, risk exposure, and long-term objectives. Performance matters, but alignment matters more.

Tax-Aware Planning & Coordination

We integrate tax strategy into every major financial decision rather than treating it as a once-a-year exercise. Working alongside CPAs and tax professionals, we help clients reduce tax drag, preserve flexibility, and avoid decisions that create future constraints. The focus is long-term efficiency, not short-term wins.

Risk Management & Wealth Protection

Protecting progress is as important as building it. We design risk management strategies that address income protection, liability exposure, estate liquidity, and business continuity. This layer of the financial compound ensures that unforeseen events do not undo years of disciplined work.

Business, Liquidity & Enterprise Planning

For entrepreneurs and enterprise-minded clients, we help align personal wealth strategy with business realities. This includes planning around cash flow, reinvestment decisions, exits, recapitalizations, and succession. The goal is to convert business success into durable personal and family wealth.

Legacy Planning and Family Stewardship

Our work extends beyond planning into long-term stewardship. We provide ongoing guidance, structured reviews, and coordination across advisors as life evolves—often across generations. This continuity helps families maintain clarity, alignment, and intentionality over decades.

Comprehensive Financial Planning & Strategy

This is the foundation of every client relationship. We build a coordinated financial strategy that integrates cash flow, investments, taxes, risk management, and long-term goals into a single plan. The objective is clarity, prioritization, and confident decision-making—not disconnected recommendations.

Investment Oversight & Asset Management

When clients engage us for asset management, we provide disciplined portfolio construction, monitoring, and ongoing oversight aligned to their broader strategy. Investment decisions are made in context—considering taxes, liquidity needs, risk exposure, and long-term objectives. Performance matters, but alignment matters more.

Tax-Aware Planning & Coordination

We integrate tax strategy into every major financial decision rather than treating it as a once-a-year exercise. Working alongside CPAs and tax professionals, we help clients reduce tax drag, preserve flexibility, and avoid decisions that create future constraints. The focus is long-term efficiency, not short-term wins.

Risk Management & Wealth Protection

Protecting progress is as important as building it. We design risk management strategies that address income protection, liability exposure, estate liquidity, and business continuity. This layer of the financial compound ensures that unforeseen events do not undo years of disciplined work.

Business, Liquidity & Enterprise Planning

For entrepreneurs and enterprise-minded clients, we help align personal wealth strategy with business realities. This includes planning around cash flow, reinvestment decisions, exits, recapitalizations, and succession. The goal is to convert business success into durable personal and family wealth.

Legacy Planning and Family Stewardship

Our work extends beyond planning into long-term stewardship. We provide ongoing guidance, structured reviews, and coordination across advisors as life evolves—often across generations. This continuity helps families maintain clarity, alignment, and intentionality over decades.

Comprehensive Financial Planning & Strategy

This is the foundation of every client relationship. We build a coordinated financial strategy that integrates cash flow, investments, taxes, risk management, and long-term goals into a single plan. The objective is clarity, prioritization, and confident decision-making—not disconnected recommendations.

Investment Oversight & Asset Management

When clients engage us for asset management, we provide disciplined portfolio construction, monitoring, and ongoing oversight aligned to their broader strategy. Investment decisions are made in context—considering taxes, liquidity needs, risk exposure, and long-term objectives. Performance matters, but alignment matters more.

Tax-Aware Planning & Coordination

We integrate tax strategy into every major financial decision rather than treating it as a once-a-year exercise. Working alongside CPAs and tax professionals, we help clients reduce tax drag, preserve flexibility, and avoid decisions that create future constraints. The focus is long-term efficiency, not short-term wins.

Risk Management & Wealth Protection

Protecting progress is as important as building it. We design risk management strategies that address income protection, liability exposure, estate liquidity, and business continuity. This layer of the financial compound ensures that unforeseen events do not undo years of disciplined work.

Business, Liquidity & Enterprise Planning

For entrepreneurs and enterprise-minded clients, we help align personal wealth strategy with business realities. This includes planning around cash flow, reinvestment decisions, exits, recapitalizations, and succession. The goal is to convert business success into durable personal and family wealth.

Legacy Planning and Family Stewardship

Our work extends beyond planning into long-term stewardship. We provide ongoing guidance, structured reviews, and coordination across advisors as life evolves—often across generations. This continuity helps families maintain clarity, alignment, and intentionality over decades.

About us

About us

About us

What We Do

12 Stones Capital Partners is a modern, faith-rooted wealth advisory firm built on collaboration, discipline, and expertise—not vanity or name recognition. We operate on a timeless principle: what you manage today is not owned outright, but entrusted to you for those who follow. Our role is to help clients see the full picture, make disciplined decisions, and steward their resources with clarity, intention, and long-term responsibility.

Our work

Our work

Our work

Who We Serve

We work with individuals and families who take their financial lives seriously.

Executives

You’ve built momentum. Now it needs structure. Your career is demanding, your income is strong, and your responsibilities keep expanding. Compensation is no longer simple—bonuses, equity, deferred plans, tax exposure. Decisions compound quickly, and mistakes are expensive. Most executives don’t lack discipline. They lack integration. At 12 Stones Capital, we help executives turn complexity into clarity. We coordinate your investments, tax strategy, protection planning, and long-term goals into one cohesive plan—so every decision reinforces the next. You don’t need more opinions. You need a framework that holds up as your career scales.

Executives

You’ve built momentum. Now it needs structure. Your career is demanding, your income is strong, and your responsibilities keep expanding. Compensation is no longer simple—bonuses, equity, deferred plans, tax exposure. Decisions compound quickly, and mistakes are expensive. Most executives don’t lack discipline. They lack integration. At 12 Stones Capital, we help executives turn complexity into clarity. We coordinate your investments, tax strategy, protection planning, and long-term goals into one cohesive plan—so every decision reinforces the next. You don’t need more opinions. You need a framework that holds up as your career scales.

Executives

You’ve built momentum. Now it needs structure. Your career is demanding, your income is strong, and your responsibilities keep expanding. Compensation is no longer simple—bonuses, equity, deferred plans, tax exposure. Decisions compound quickly, and mistakes are expensive. Most executives don’t lack discipline. They lack integration. At 12 Stones Capital, we help executives turn complexity into clarity. We coordinate your investments, tax strategy, protection planning, and long-term goals into one cohesive plan—so every decision reinforces the next. You don’t need more opinions. You need a framework that holds up as your career scales.

Founders

Your business is moving fast. Your personal plan shouldn’t lag behind. As an entrepreneur, you live in uncertainty by design. Cash flow fluctuates. Opportunities appear quickly. Risk is part of the game. But when your personal finances are reactive—or overly tied to the business—you carry more exposure than necessary. We work with founders and operators to bring separation and structure where it matters most. Our role is to help you convert business success into sustainable personal wealth, while protecting against the risks that come with concentration. We help you: • Make confident reinvestment vs. extraction decisions • Prepare for liquidity events before they happen • Build a balance sheet that doesn’t rely on one outcome You're building a company. We help ensure the results actually last.

Founders

Your business is moving fast. Your personal plan shouldn’t lag behind. As an entrepreneur, you live in uncertainty by design. Cash flow fluctuates. Opportunities appear quickly. Risk is part of the game. But when your personal finances are reactive—or overly tied to the business—you carry more exposure than necessary. We work with founders and operators to bring separation and structure where it matters most. Our role is to help you convert business success into sustainable personal wealth, while protecting against the risks that come with concentration. We help you: • Make confident reinvestment vs. extraction decisions • Prepare for liquidity events before they happen • Build a balance sheet that doesn’t rely on one outcome You're building a company. We help ensure the results actually last.

Founders

Your business is moving fast. Your personal plan shouldn’t lag behind. As an entrepreneur, you live in uncertainty by design. Cash flow fluctuates. Opportunities appear quickly. Risk is part of the game. But when your personal finances are reactive—or overly tied to the business—you carry more exposure than necessary. We work with founders and operators to bring separation and structure where it matters most. Our role is to help you convert business success into sustainable personal wealth, while protecting against the risks that come with concentration. We help you: • Make confident reinvestment vs. extraction decisions • Prepare for liquidity events before they happen • Build a balance sheet that doesn’t rely on one outcome You're building a company. We help ensure the results actually last.

Testimonials

Testimonials

Testimonials

The Good News

Hear from our happy clients about their experience working with 12 Stones Capital Partners.

Refit did an incredible job on our kitchen. The craftsmanship was top-notch, and the team was professional from start to finish. Highly recommend!

Emily Carter

Brilliant service from start to finish. The team was professional, communicative, and the results exceeded my expectations. My new bathroom looks amazing!

James Richardson

I couldn’t be happier with my loft conversion. The attention to detail and quality of work were outstanding. Refit made the whole process smooth and stress-free!

Sophie Williams

Refit transformed our outdoor space with a beautiful garden path. The work was completed on time, and the finish is excellent. A great team to work with!

Daniel Foster

From the first consultation to the final touches, Refit delivered on every promise. Our home extension is exactly what we wanted—spacious, modern, and beautifully finished!

Charlotte Harris

Fantastic workmanship! The team renovated our bathroom with precision and care. It now feels like a luxury space. Would definitely use Refit again.

Oliver Bennett

Fantastic workmanship! The team renovated our bathroom with precision and care. It now feels like a luxury space. Would definitely use Refit again.

Oliver Bennett

From the first consultation to the final touches, Refit delivered on every promise. Our home extension is exactly what we wanted—spacious, modern, and beautifully finished!

Charlotte Harris

Refit transformed our outdoor space with a beautiful garden path. The work was completed on time, and the finish is excellent. A great team to work with!

Daniel Foster

I couldn’t be happier with my loft conversion. The attention to detail and quality of work were outstanding. Refit made the whole process smooth and stress-free!

Sophie Williams

Brilliant service from start to finish. The team was professional, communicative, and the results exceeded my expectations. My new bathroom looks amazing!

James Richardson

Refit did an incredible job on our kitchen. The craftsmanship was top-notch, and the team was professional from start to finish. Highly recommend!

Emily Carter

Refit did an incredible job on our kitchen. The craftsmanship was top-notch, and the team was professional from start to finish. Highly recommend!

Emily Carter

Brilliant service from start to finish. The team was professional, communicative, and the results exceeded my expectations. My new bathroom looks amazing!

James Richardson

I couldn’t be happier with my loft conversion. The attention to detail and quality of work were outstanding. Refit made the whole process smooth and stress-free!

Sophie Williams

Refit transformed our outdoor space with a beautiful garden path. The work was completed on time, and the finish is excellent. A great team to work with!

Daniel Foster

From the first consultation to the final touches, Refit delivered on every promise. Our home extension is exactly what we wanted—spacious, modern, and beautifully finished!

Charlotte Harris

Fantastic workmanship! The team renovated our bathroom with precision and care. It now feels like a luxury space. Would definitely use Refit again.

Oliver Bennett

Refit did an incredible job on our kitchen. The craftsmanship was top-notch, and the team was professional from start to finish. Highly recommend!

Emily Carter

Brilliant service from start to finish. The team was professional, communicative, and the results exceeded my expectations. My new bathroom looks amazing!

James Richardson

I couldn’t be happier with my loft conversion. The attention to detail and quality of work were outstanding. Refit made the whole process smooth and stress-free!

Sophie Williams

Refit transformed our outdoor space with a beautiful garden path. The work was completed on time, and the finish is excellent. A great team to work with!

Daniel Foster

From the first consultation to the final touches, Refit delivered on every promise. Our home extension is exactly what we wanted—spacious, modern, and beautifully finished!

Charlotte Harris

Fantastic workmanship! The team renovated our bathroom with precision and care. It now feels like a luxury space. Would definitely use Refit again.

Oliver Bennett

Refit did an incredible job on our kitchen. The craftsmanship was top-notch, and the team was professional from start to finish. Highly recommend!

Emily Carter

Brilliant service from start to finish. The team was professional, communicative, and the results exceeded my expectations. My new bathroom looks amazing!

James Richardson

I couldn’t be happier with my loft conversion. The attention to detail and quality of work were outstanding. Refit made the whole process smooth and stress-free!

Sophie Williams

Refit transformed our outdoor space with a beautiful garden path. The work was completed on time, and the finish is excellent. A great team to work with!

Daniel Foster

From the first consultation to the final touches, Refit delivered on every promise. Our home extension is exactly what we wanted—spacious, modern, and beautifully finished!

Charlotte Harris

Fantastic workmanship! The team renovated our bathroom with precision and care. It now feels like a luxury space. Would definitely use Refit again.

Oliver Bennett

Refit did an incredible job on our kitchen. The craftsmanship was top-notch, and the team was professional from start to finish. Highly recommend!

Emily Carter

Brilliant service from start to finish. The team was professional, communicative, and the results exceeded my expectations. My new bathroom looks amazing!

James Richardson

I couldn’t be happier with my loft conversion. The attention to detail and quality of work were outstanding. Refit made the whole process smooth and stress-free!

Sophie Williams

Refit transformed our outdoor space with a beautiful garden path. The work was completed on time, and the finish is excellent. A great team to work with!

Daniel Foster

From the first consultation to the final touches, Refit delivered on every promise. Our home extension is exactly what we wanted—spacious, modern, and beautifully finished!

Charlotte Harris

Fantastic workmanship! The team renovated our bathroom with precision and care. It now feels like a luxury space. Would definitely use Refit again.

Oliver Bennett

Refit did an incredible job on our kitchen. The craftsmanship was top-notch, and the team was professional from start to finish. Highly recommend!

Emily Carter

Brilliant service from start to finish. The team was professional, communicative, and the results exceeded my expectations. My new bathroom looks amazing!

James Richardson

I couldn’t be happier with my loft conversion. The attention to detail and quality of work were outstanding. Refit made the whole process smooth and stress-free!

Sophie Williams

Refit transformed our outdoor space with a beautiful garden path. The work was completed on time, and the finish is excellent. A great team to work with!

Daniel Foster

From the first consultation to the final touches, Refit delivered on every promise. Our home extension is exactly what we wanted—spacious, modern, and beautifully finished!

Charlotte Harris

Fantastic workmanship! The team renovated our bathroom with precision and care. It now feels like a luxury space. Would definitely use Refit again.

Oliver Bennett

Fantastic workmanship! The team renovated our bathroom with precision and care. It now feels like a luxury space. Would definitely use Refit again.

Oliver Bennett

From the first consultation to the final touches, Refit delivered on every promise. Our home extension is exactly what we wanted—spacious, modern, and beautifully finished!

Charlotte Harris

Refit transformed our outdoor space with a beautiful garden path. The work was completed on time, and the finish is excellent. A great team to work with!

Daniel Foster

I couldn’t be happier with my loft conversion. The attention to detail and quality of work were outstanding. Refit made the whole process smooth and stress-free!

Sophie Williams

Brilliant service from start to finish. The team was professional, communicative, and the results exceeded my expectations. My new bathroom looks amazing!

James Richardson

Refit did an incredible job on our kitchen. The craftsmanship was top-notch, and the team was professional from start to finish. Highly recommend!

Emily Carter

FAQs

FAQs

FAQs

Answering your questions

Answering your questions

Answering your questions

Got more questions? Send us your enquiry below

Got more questions? Send us your enquiry below

Got more questions? Send us your enquiry below

Do I actually have a clear plan—or just a collection of accounts and advisors?

Most high performers accumulate accounts, strategies, and advisors faster than clarity. What feels like diversification is often fragmentation. We help clients step back, define a single strategic plan, and ensure every decision—investment, tax, or business-related—reinforces the same long-term objective.

What does the client/ advisor relationship entail?

Our relationships are designed to unfold in phases, not transactions. The first 12–24 months are focused on getting fully acquainted—organizing your financial life, aligning strategy across investments, tax planning, risk management, and defining clear priorities. During this period, we establish structure, decision frameworks, and a shared understanding of what matters most. Beyond that foundation, our role becomes long-term stewardship. We work alongside clients and, when appropriate, their families to provide continuity, coordination, and perspective as circumstances change across careers, businesses, and generations. The objective is not short-term optimization, but durable guidance that evolves over a lifetime.

What does success actually look like if we work together?

Success is different for every client, but it should always be defined. We help clients articulate what they are building toward—whether that’s optionality, enterprise continuity, or legacy—and align every strategy accordingly. Progress is measured by clarity, confidence, and control, not just returns.

Are you working in a fiduciary capacity?

Yes—when we provide investment advisory services, we act in a fiduciary capacity. That means we are legally and ethically obligated to put our clients’ interests ahead of our own, disclose conflicts, and provide advice we believe is in their best interest. Our fiduciary responsibility applies to the scope of advisory services we provide. In certain situations, such as insurance or commission-based transactions, we clearly disclose the role we are acting in and the compensation involved—so there are no surprises. Our standard is simple: clarity, transparency, and alignment. Clients should always understand how advice is given, how decisions are made, and how we are compensated.

What is the financial compound?

We believe the strongest wealth is built like a compound—not a single structure, but a fortified system where every part protects and reinforces the whole. At 12 Stones Capital, we help clients design a financial compound by intentionally managing every major arm of their financial life: income, investments, taxes, risk management, business interests, estate planning, and family considerations. Each component has a role. Each layer adds protection, resilience, and optionality. When these elements are built in isolation, the structure is vulnerable. When they are coordinated deliberately, the result is strength—against market volatility, unexpected life events, business risk, and generational transitions. Over time, this integrated approach compounds not just returns, but security, flexibility, and control. Our role is to help clients construct, maintain, and steward this compound over decades—adapting as life evolves, while ensuring the foundation remains sound. This is how wealth is preserved, protected, and passed on with intention.

How are you compensated?

Our compensation is intentionally structured to separate financial planning and advisory work from asset management services. Planning fees reflect the time, expertise, and responsibility involved in understanding your full financial picture—organizing complexity, coordinating strategy across investments, taxes, risk management, business interests, and estate planning, and providing ongoing guidance and decision support. This work stands on its own and is not dependent on whether assets are managed. Asset management fees apply only when we are directly managing investments on your behalf. These fees are based on the assets under management and cover portfolio construction, monitoring, rebalancing, and ongoing oversight. This separation ensures transparency and alignment. Clients understand what they are paying for, and advice is not contingent on asset placement. All fees are disclosed upfront, with no hidden compensation or surprises.

Can I pay for one-off services versus relationship-focused work?

In most cases, our work is designed around an ongoing advisory relationship rather than one-off engagements. The decisions we help clients navigate—across investments, taxes, risk, business, and family considerations—are interconnected and best addressed through continuity, not isolated recommendations. That said, in limited situations we may offer scoped or project-based planning when it serves as a gateway to a longer-term relationship. Our preference is to work with clients who value sustained guidance, accountability, and stewardship over time, rather than transactional advice.

Do I actually have a clear plan—or just a collection of accounts and advisors?

Most high performers accumulate accounts, strategies, and advisors faster than clarity. What feels like diversification is often fragmentation. We help clients step back, define a single strategic plan, and ensure every decision—investment, tax, or business-related—reinforces the same long-term objective.

What does the client/ advisor relationship entail?

Our relationships are designed to unfold in phases, not transactions. The first 12–24 months are focused on getting fully acquainted—organizing your financial life, aligning strategy across investments, tax planning, risk management, and defining clear priorities. During this period, we establish structure, decision frameworks, and a shared understanding of what matters most. Beyond that foundation, our role becomes long-term stewardship. We work alongside clients and, when appropriate, their families to provide continuity, coordination, and perspective as circumstances change across careers, businesses, and generations. The objective is not short-term optimization, but durable guidance that evolves over a lifetime.

What does success actually look like if we work together?

Success is different for every client, but it should always be defined. We help clients articulate what they are building toward—whether that’s optionality, enterprise continuity, or legacy—and align every strategy accordingly. Progress is measured by clarity, confidence, and control, not just returns.

Are you working in a fiduciary capacity?

Yes—when we provide investment advisory services, we act in a fiduciary capacity. That means we are legally and ethically obligated to put our clients’ interests ahead of our own, disclose conflicts, and provide advice we believe is in their best interest. Our fiduciary responsibility applies to the scope of advisory services we provide. In certain situations, such as insurance or commission-based transactions, we clearly disclose the role we are acting in and the compensation involved—so there are no surprises. Our standard is simple: clarity, transparency, and alignment. Clients should always understand how advice is given, how decisions are made, and how we are compensated.

What is the financial compound?

We believe the strongest wealth is built like a compound—not a single structure, but a fortified system where every part protects and reinforces the whole. At 12 Stones Capital, we help clients design a financial compound by intentionally managing every major arm of their financial life: income, investments, taxes, risk management, business interests, estate planning, and family considerations. Each component has a role. Each layer adds protection, resilience, and optionality. When these elements are built in isolation, the structure is vulnerable. When they are coordinated deliberately, the result is strength—against market volatility, unexpected life events, business risk, and generational transitions. Over time, this integrated approach compounds not just returns, but security, flexibility, and control. Our role is to help clients construct, maintain, and steward this compound over decades—adapting as life evolves, while ensuring the foundation remains sound. This is how wealth is preserved, protected, and passed on with intention.

How are you compensated?

Our compensation is intentionally structured to separate financial planning and advisory work from asset management services. Planning fees reflect the time, expertise, and responsibility involved in understanding your full financial picture—organizing complexity, coordinating strategy across investments, taxes, risk management, business interests, and estate planning, and providing ongoing guidance and decision support. This work stands on its own and is not dependent on whether assets are managed. Asset management fees apply only when we are directly managing investments on your behalf. These fees are based on the assets under management and cover portfolio construction, monitoring, rebalancing, and ongoing oversight. This separation ensures transparency and alignment. Clients understand what they are paying for, and advice is not contingent on asset placement. All fees are disclosed upfront, with no hidden compensation or surprises.

Can I pay for one-off services versus relationship-focused work?

In most cases, our work is designed around an ongoing advisory relationship rather than one-off engagements. The decisions we help clients navigate—across investments, taxes, risk, business, and family considerations—are interconnected and best addressed through continuity, not isolated recommendations. That said, in limited situations we may offer scoped or project-based planning when it serves as a gateway to a longer-term relationship. Our preference is to work with clients who value sustained guidance, accountability, and stewardship over time, rather than transactional advice.

Do I actually have a clear plan—or just a collection of accounts and advisors?

Most high performers accumulate accounts, strategies, and advisors faster than clarity. What feels like diversification is often fragmentation. We help clients step back, define a single strategic plan, and ensure every decision—investment, tax, or business-related—reinforces the same long-term objective.

What does the client/ advisor relationship entail?

Our relationships are designed to unfold in phases, not transactions. The first 12–24 months are focused on getting fully acquainted—organizing your financial life, aligning strategy across investments, tax planning, risk management, and defining clear priorities. During this period, we establish structure, decision frameworks, and a shared understanding of what matters most. Beyond that foundation, our role becomes long-term stewardship. We work alongside clients and, when appropriate, their families to provide continuity, coordination, and perspective as circumstances change across careers, businesses, and generations. The objective is not short-term optimization, but durable guidance that evolves over a lifetime.

What does success actually look like if we work together?

Success is different for every client, but it should always be defined. We help clients articulate what they are building toward—whether that’s optionality, enterprise continuity, or legacy—and align every strategy accordingly. Progress is measured by clarity, confidence, and control, not just returns.

Are you working in a fiduciary capacity?

Yes—when we provide investment advisory services, we act in a fiduciary capacity. That means we are legally and ethically obligated to put our clients’ interests ahead of our own, disclose conflicts, and provide advice we believe is in their best interest. Our fiduciary responsibility applies to the scope of advisory services we provide. In certain situations, such as insurance or commission-based transactions, we clearly disclose the role we are acting in and the compensation involved—so there are no surprises. Our standard is simple: clarity, transparency, and alignment. Clients should always understand how advice is given, how decisions are made, and how we are compensated.

What is the financial compound?

We believe the strongest wealth is built like a compound—not a single structure, but a fortified system where every part protects and reinforces the whole. At 12 Stones Capital, we help clients design a financial compound by intentionally managing every major arm of their financial life: income, investments, taxes, risk management, business interests, estate planning, and family considerations. Each component has a role. Each layer adds protection, resilience, and optionality. When these elements are built in isolation, the structure is vulnerable. When they are coordinated deliberately, the result is strength—against market volatility, unexpected life events, business risk, and generational transitions. Over time, this integrated approach compounds not just returns, but security, flexibility, and control. Our role is to help clients construct, maintain, and steward this compound over decades—adapting as life evolves, while ensuring the foundation remains sound. This is how wealth is preserved, protected, and passed on with intention.

How are you compensated?

Our compensation is intentionally structured to separate financial planning and advisory work from asset management services. Planning fees reflect the time, expertise, and responsibility involved in understanding your full financial picture—organizing complexity, coordinating strategy across investments, taxes, risk management, business interests, and estate planning, and providing ongoing guidance and decision support. This work stands on its own and is not dependent on whether assets are managed. Asset management fees apply only when we are directly managing investments on your behalf. These fees are based on the assets under management and cover portfolio construction, monitoring, rebalancing, and ongoing oversight. This separation ensures transparency and alignment. Clients understand what they are paying for, and advice is not contingent on asset placement. All fees are disclosed upfront, with no hidden compensation or surprises.

Can I pay for one-off services versus relationship-focused work?

In most cases, our work is designed around an ongoing advisory relationship rather than one-off engagements. The decisions we help clients navigate—across investments, taxes, risk, business, and family considerations—are interconnected and best addressed through continuity, not isolated recommendations. That said, in limited situations we may offer scoped or project-based planning when it serves as a gateway to a longer-term relationship. Our preference is to work with clients who value sustained guidance, accountability, and stewardship over time, rather than transactional advice.

Contact

Contact

Contact

Get in touch

Office

1700 S Pavilion Dr Ste 320, Las Vegas, NV 89135

167-169 Great Portland Street,

W1W 5PF